The Effects of Currency Depreciation

The effects of currency depreciation can be well illustrated by studying one of the worst hit countries in the world; Zimbabwe.

For a country that has seen tough times in the form of international sanctions and political instability, one thing left the whole nation tumbling; currency depreciation.

In 2007, Zimbabwe recorded the second highest inflation in history. The government stopped reporting the numbers after inflation had reached 100,000 percent.

A loaf of bread cost 30 Billion Zimbabwean Dollars. Employees stopped going to work as their annual salaries couldn’t pay for a bus ride back home. The central bank kept printing bigger and bigger bank notes. A million dollar note, a one hundred billion note and eventually a one hundred trillion note that was worth only 40 U.S. cents.

Eventually the currency collapsed and they adopted the U.S. dollar as their primary currency.

You can imagine what happened to the wealthy people in Zimbabwe who had held their assets in Zimbabwean dollars. They were not even rich in Zimbabwe anymore. Their “big” portfolios wouldn’t help them as the currency depreciation effects had tanked the value of their wealth.

Of course, Zimbabwe is an exception and an extreme example, but it drives the point home. When you are an investor, investing in emerging and frontier markets, you can’t stop worrying about currency depreciation.

As a matter of fact, currency depreciation is one of the reasons why foreign investors have fled the Nairobi Securities Exchange in the past few years. This is because they have to adjust their returns from the NSE and evaluate them as USD returns. For example if a counter returned 10% in 2023, and the currency depreciation was at 22%, the real USD return was negative 12%

The Weakening KES

Last year(2023) was one of the worst years for the Kenyan Shilling. A depreciation rate of 21 percent against the U.S. dollar saw it rank among the worst performing currencies in the world as shown by this Bloomberg chart.

Like I previously wrote, currency depreciation is one of the greatest threats that investors in the frontier and emerging markets face due to the instability of the base currencies holding their assets.

The Most Popular Financial Advice for 2023

The most popular piece of financial advice of 2023 was, “Convert your Savings in KES to USD since the KES is depreciating at an alarming rate.”

While this piece of advice was right, it was half baked advice.

It wasn’t the best answer to the problem of currency depreciation or in this case, currency depreciation.

This piece of advice was incomplete since it treated the symptoms of the disease instead of looking at the root cause of the disease.

How To Protect Your Portfolio from The Weakening KES

The main goal of investing is to build and protect our wealth. While doing so, we must protect our portfolios from the several risks that we face as investors. These include: inflation risk, currency or country risk, market risk, concentration risk, etc.

For this scenario, we are focusing on how to protect our portfolio from currency risk.

According to Investopedia, currency risk is the possibility of losing money due to unfavorable moves in exchange rates.

The only way to do this is by holding your portfolio in a more stable currency like the U.S dollar or holding assets that aren’t pegged to any currency like Gold or Bitcoin.

Building A Portfolio of USD Backed Assets

Like I earlier mentioned, the option to convert your savings from KES to USD was half baked advice. Because we all know that holding cash in a bank account isn’t an investment.

Hence the full baked advice would have been to convert your KES savings to USD and invest in USD backed assets or assets not backed by any currency like gold or crypto.

In theory, the person who converted their savings from KES to USD at the beginning of the year made a gross return of about 22%

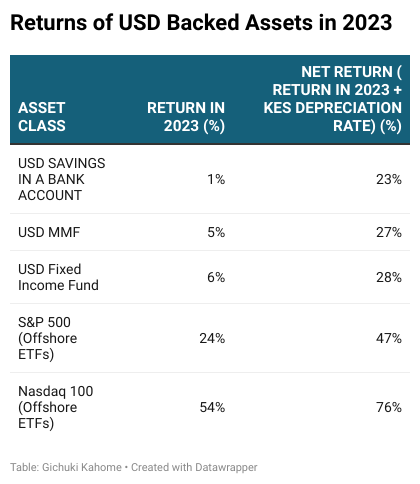

But what about the one who went on ahead to invest their USD savings to USD backed assets like USD Money Market Funds, USD Fixed income funds, Eurobonds, Offshore stocks, Offshore ETFs, etc

Asset Classes To Consider

Short term investments

USD MMFs – best for people who earn in USD or do business in USD. If you earn in KES, be careful with this more so when using it for short term investments as you foreign exchange rates may eat into your returns for the short term.

You can open a USD MMF with KUZA Asset Management under this link

LONG TERM ASSETS

1. Offshore stocks & ETFs – Great for long term investing. Access to passive investing in ETFs makes it easy for the average investor to invest in the stock market.

2. Eurobonds. They are tax free and you get to enjoy both coupons and capital appreciation through discounted pricing.

3. Other USD funds. These include USD Fixed income funds and USD managed funds

Final Words

Whether you are just getting started with investing or you are a seasoned investor, I hope you picked something from this article. I will do more articles breaking down each of these asset classes in detail.

As you continue to build your portfolio, be aware of the various risks that your portfolio is exposed to and how you can protect your wealth from them. Other risks include: inflation risk, concentration risk, market risk, etc.