If there’s one threat that investors in the frontier and emerging markets are exposed to, then it has to be the risk of currency depreciation.

You may be having a high value portfolio but holding it in a currency that is quickly losing its value. Hence you are very wealthy in that country but very poor compared to the global standards. Hence as your country goes from poor to poorer, your wealth also follows suit despite you working hard to build more wealth.

For context, currency depreciation is a fall in the value of a currency in terms of its exchange rate versus other currencies. It is caused by factors such as economic fundamentals, political instability, interest rate differentials among others.

Countries with huge trade deficits and high rates of inflation generally have depreciating currencies. Currency depreciation, if orderly and gradual, improves a nation’s export competitiveness and may improve its trade deficit over time. But an abrupt and sizable currency depreciation may scare foreign investors who fear the currency may fall further.

And this is one of the reasons as to why we are seeing foreigners flee our local bourse, the Nairobi Securities Exchange.

When interest rates are hiked, bonds in developed countries fetch high yields which attract foreign investors who had reserved their capital in developed countries.

The Economic Tumble of Zimbabwe

The effects of currency depreciation can be well illustrated by studying one of the worst hit countries which is Zimbabwe.

For a country that has seen tough times like international sanctions and political instability, one thing left the whole nation tumbling; currency devaluation.

In 2007, Zimbabwe recorded the second highest inflation in history. The government stopped reporting the numbers after inflation had reached 100,000 percent.

A loaf of bread cost 30 Billion Zimbabwean dollars. Employees stopped going to work as their annual salaries couldn’t pay for a bus ride back home. The central bank kept printing bigger and bigger bank notes. A million dollar note, a one hundred billion note and eventually a one hundred trillion note that was worth only 40 U.S. cents.

Eventually the currency collapsed and they adopted the U.S. dollar as their primary currency.

You can imagine what happened to the wealthy people in Zimbabwe who had held their assets in Zimbabwean dollars. They were not even rich in Zimbabwe. Their portfolios wouldn’t help them do anything financially.

Of course, Zimbabwe is an exception and an extreme example but it drives the point home. When you are an investor in a developing country, you can’t stop worrying about currency depreciation.

The Weakening Kenyan Shilling

Of course the story of Zimbabwe is an extreme example to use because it shows the worst that can happen.

However, it does a good job in helping us understand the risk of currency depreciation.

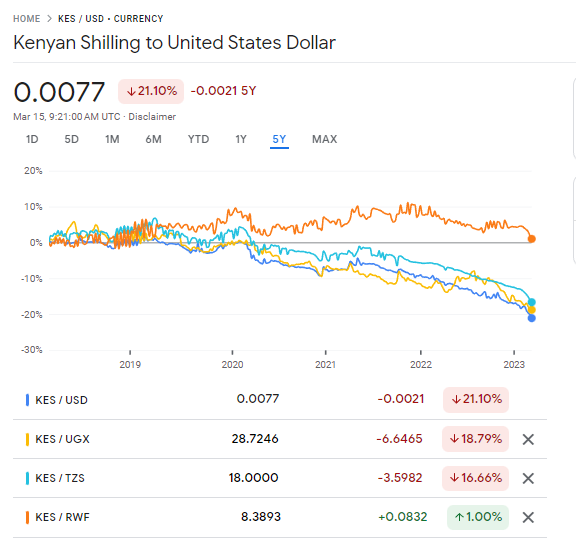

Taking a closer look home, looking at a bigger picture will help you understand the risks that come with currency depreciation. As you can see from the chart below, the Kenyan shilling has been losing not only to the U.S. dollar but also to our neighbors currencies.

Even though there are better factors like Gross Domestic Growth (GDP) that are better predictors of how the economy is performing, the drop in the value of the Kenyan shilling compared to the currency of our neighbors paints part of the picture of how we are doing economically.

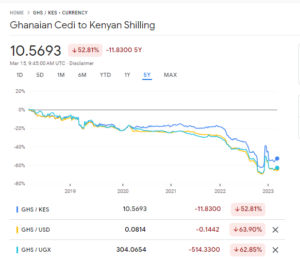

Ghana is in A Worse State

The Ghanaian Cedi is doing even worse due to their current economic turmoil.

How Currency Depreciation Affects Your Portfolio

Holding your assets in a depreciating currency means that the asset has to fetch higher returns for your portfolio to have a positive net return when all factors are considered. This means that you are not only focusing on beating the inflation rate and investment costs but also the currency depreciation rate.

For example, the Kenyan shilling is down 21% compared to the U.S. dollar in the past 5 years. This means that for a portfolio that is held in Kenyan shillings, it not only beats inflation and investment costs but also reduces the effect of the currency depreciation.

Moreover, someone who had just converted his cash into U.S. dollars and put the money in a bank account made more money than him doing nothing and taking zero risk.

How To Hedge Against The Risk of Currency Depreciation

As an investor, the easiest way to protect your portfolio against currency depreciation risk is by holding some of your assets in stronger currencies.

This may include buying foreign stocks and Exchange Traded Funds. That way your assets are held in a stronger currency and the only thing you can worry about is the returns that beat the inflation rate and investment costs.