Treasury bonds are a secure investment option, offering higher interest rates than savings or fixed deposit accounts. They provide a reliable income stream with near-guaranteed returns and semi-annual interest payments. Additionally, tax-free infrastructure bonds allow investors to maximize their earnings and increase their tax efficiency.

In this guide, I will cover the step-by-step process for placing a bid via the DhowCSD platform. To place a bid you must have a Dhow CSD account which you can now do easily online. If you are new to treasury bonds, check out my article on How to Invest in Treasury Bonds in Kenya; it explains exactly what they are and how you can use them to your advantage. However, the methods outlined for getting a CDS account have become outdated as the CBK has streamlined the process via its DhowCSD app.

Opening a CDS account via the DhowCSD Portal

The launch of the DhowCSD platform by the CBK brought with it several changes aimed at streamlining the system. Opening a CDS account used to take at least 14 working days and required a physical visit to CBK offices. Now, you can complete the application online via the app or portal and have your account ready in 48 hours. Similarly, while retail investors once placed bond bids using a USSD code, you can now do so easily through the app or portal, as CBK no longer accepts manual submissions or drop-offs at its centres.

Additionally, all payments must be made through a commercial bank, as CBK has phased out cash payments. Thankfully, most banks offer online and mobile banking services, so you can manage your transactions without visiting the bank.

If you had a CDS account with CBK, your details have already been transferred to the new system. You just need to download the app or visit the online portal to activate your account. Alternatively, if your CDS account was with a bank, stockbroker, or another third party, that was a nominee account, your bank or broker will also move it online. If you want to create an individual CDS account to invest directly with CBK, open a new account.

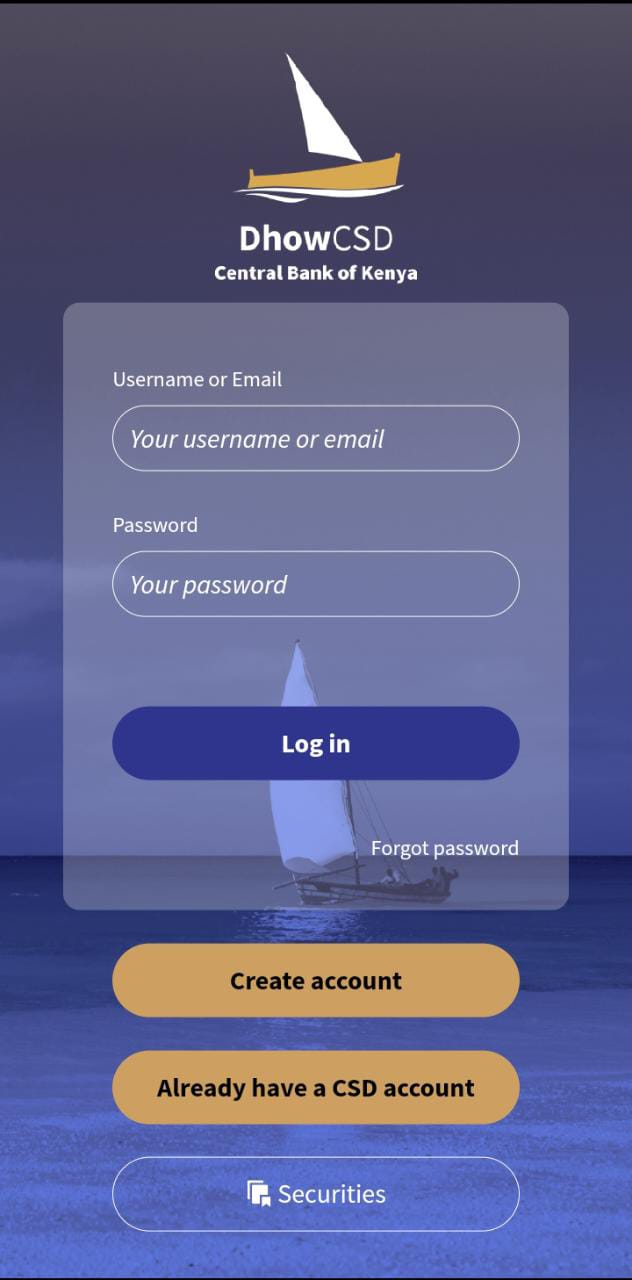

Before opening a CDS account, download the DhowCSD app from the Google Play Store, or Apple Store. Alternatively, you can go to the Online Portal. Meanwhile, prepare clear digital photos/scans:

- A clear, Colored passport photo

- Your Identification document (ID or passport or Alien card)

- Your KRA pin

After downloading the app or visiting the online portal, follow the steps below:

1. Create a new account or activate your existing online account

If you do not have an existing account, create a new one. For those who have accounts in the previous system, all you have to do is click activate account. Afterwards, you will be prompted to fill in your details and upload the necessary documents. It’s a straightforward process.

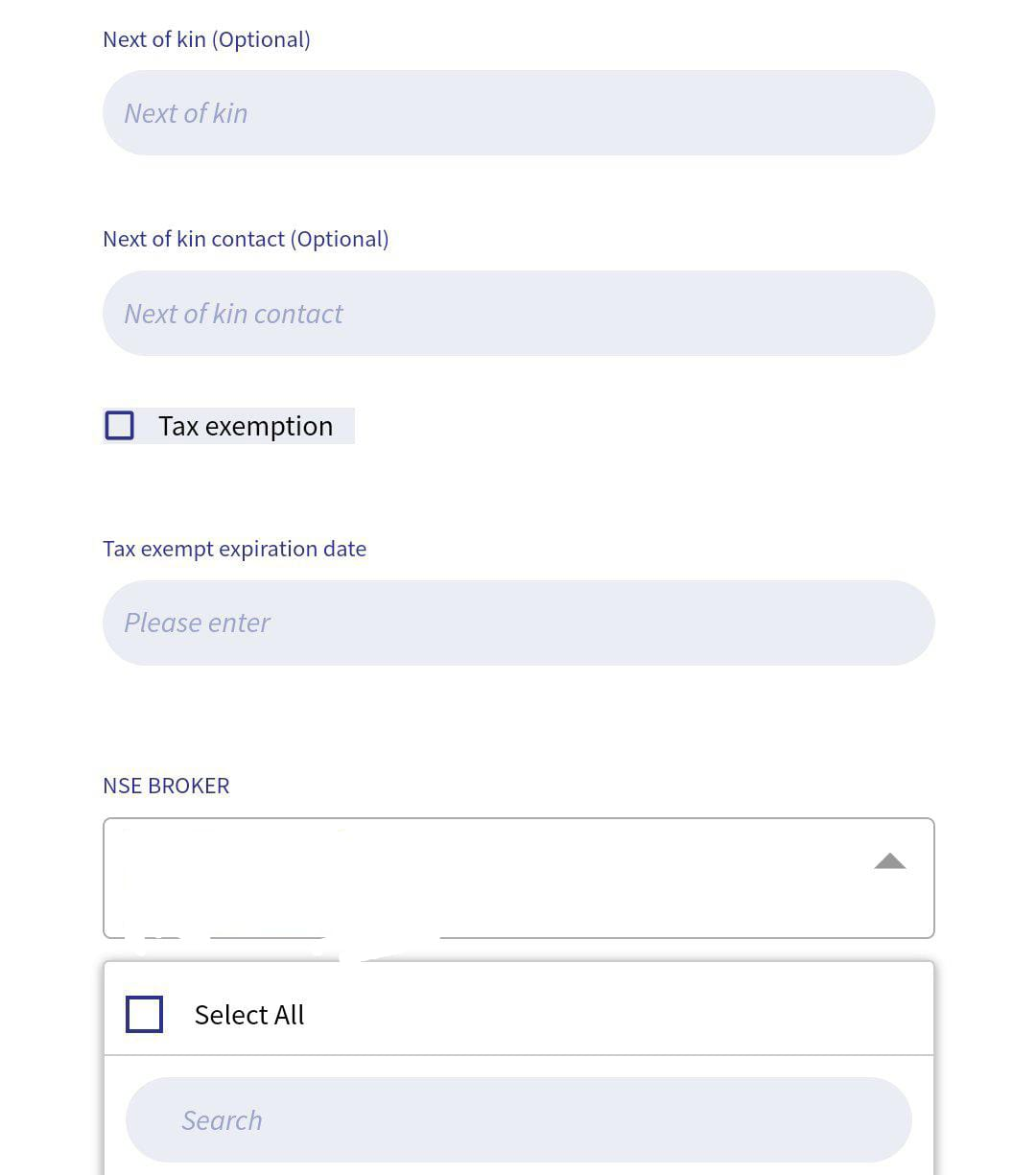

2. Consider if you need a stock broker

Your NSE broker will assist you in trading on the secondary market. However, if you don’t have an NSE broker, skip this step. You can always add a broker later after you’ve opened your account.

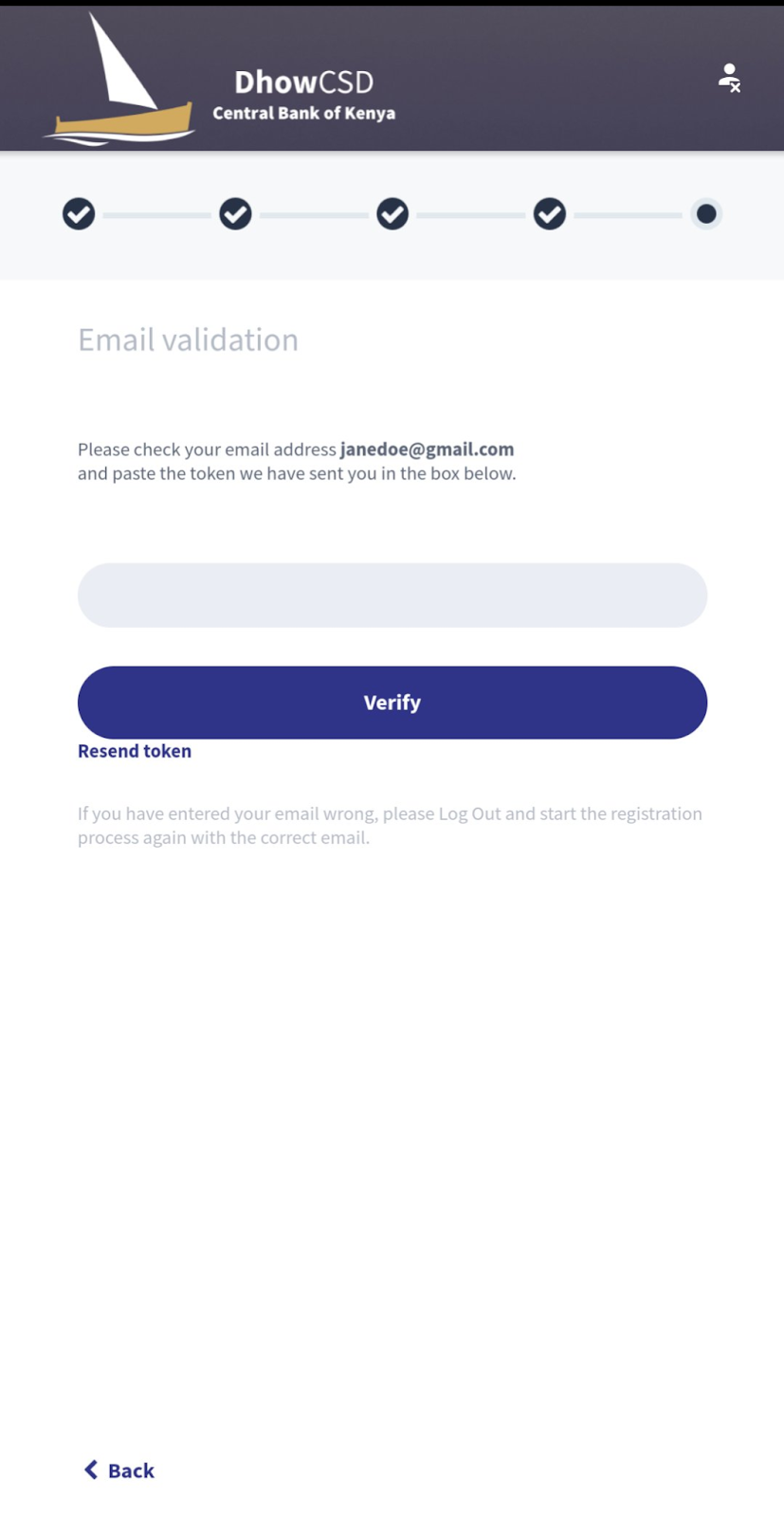

3. Verify your Email.

After completing the registration process, you will be prompted to verify your email via a token. You should receive the token immediately. If you don’t receive the email verification token immediately, first check your spam folder or promotions tab. If you still don’t see it, try clicking on “resend token.” If the token still doesn’t arrive, you can try again later.

Within 48 hours you should receive approval from the CBK and your account will be greenlit to place bids on government treasury bonds and bills.

Placing a Bid via the DhowCSD Platform

1. Log in to your DhowCSD Account

Once your account is set up, the first step is to log in using your email address or username and password.

2. Find Securities available for Auction

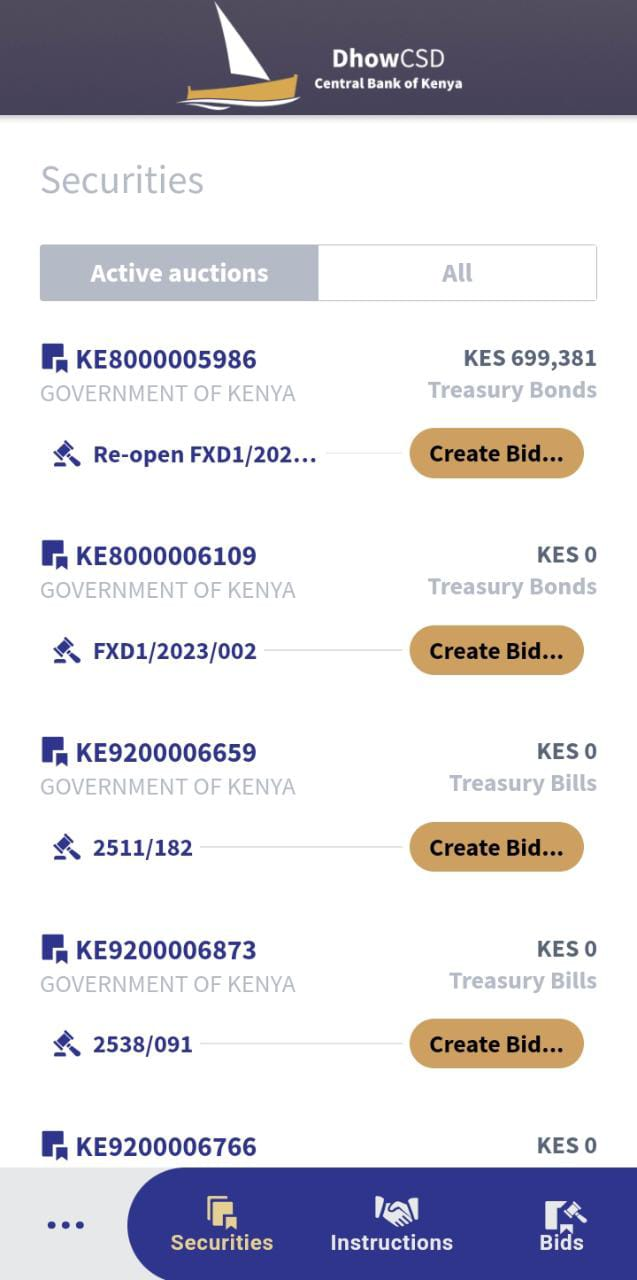

After logging in, click “Buy/Sell” in the bottom right corner, then select “Securities.” Under “Active Auctions,” you’ll find a list of all securities currently up for auction, including both T-bonds and T-bills.

3. Get Full Details of a bond issuance

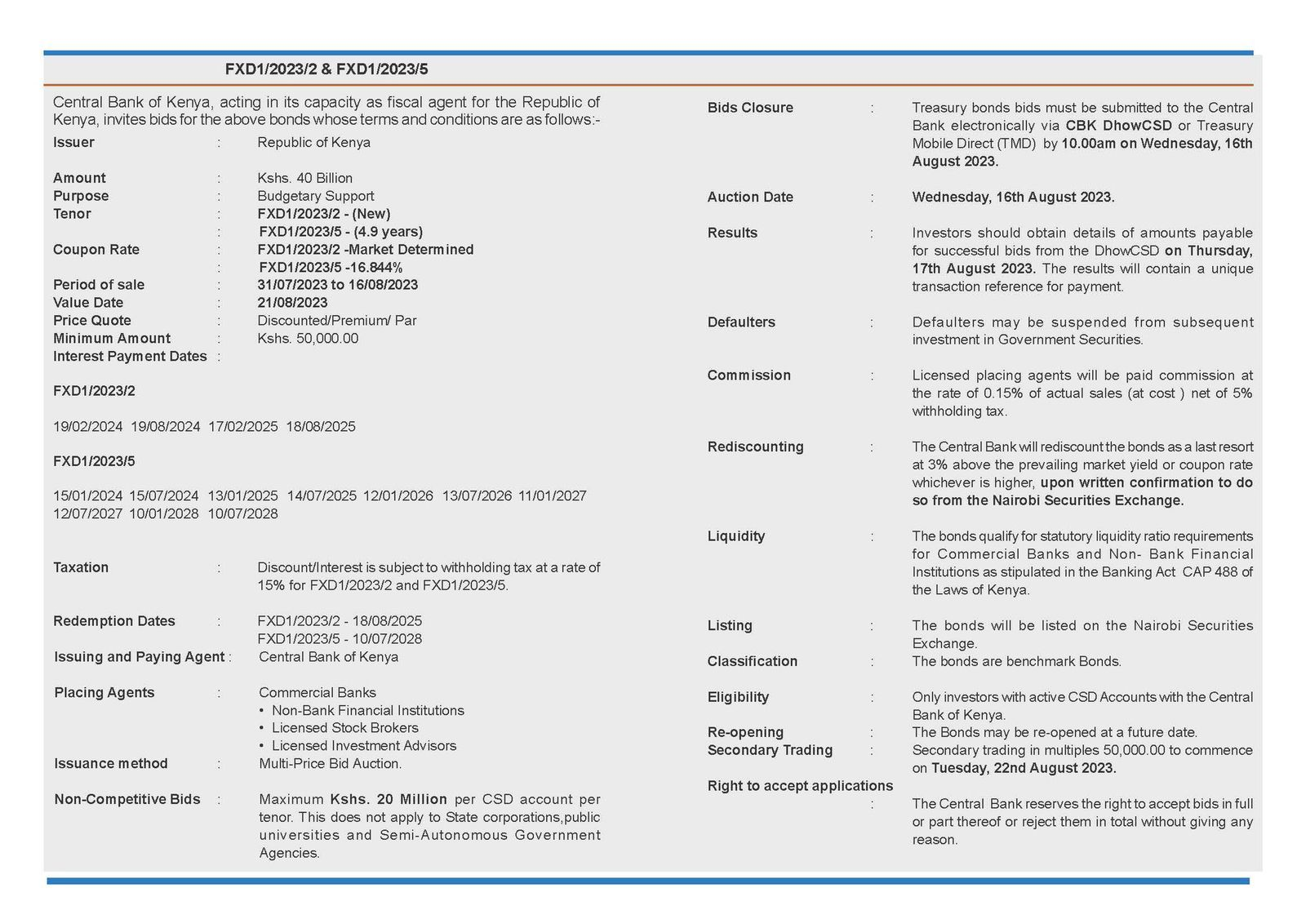

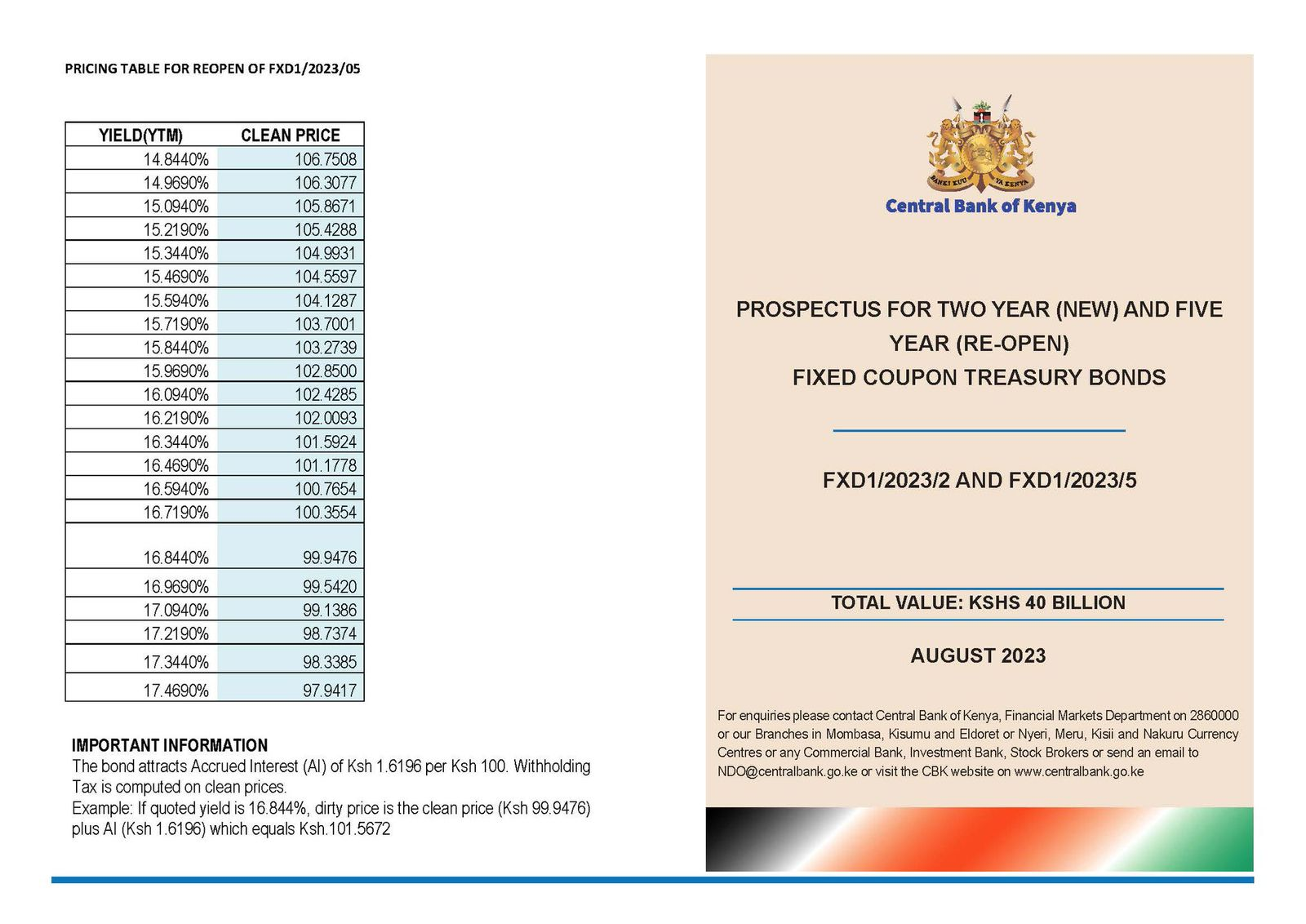

At the time of writing, there were two bonds available as detailed in the prospectus shared by the CBK:

1. FXD1/2023/5 (Re-opened bond)

2. FXD1/2023/2 (New Issue)

For full details on each bond issuance, please refer to the prospectus issued by CBK, which is attached below. These are always provided by the CBK] whenever a new bond is availed for bidding.

4. Place your Bid

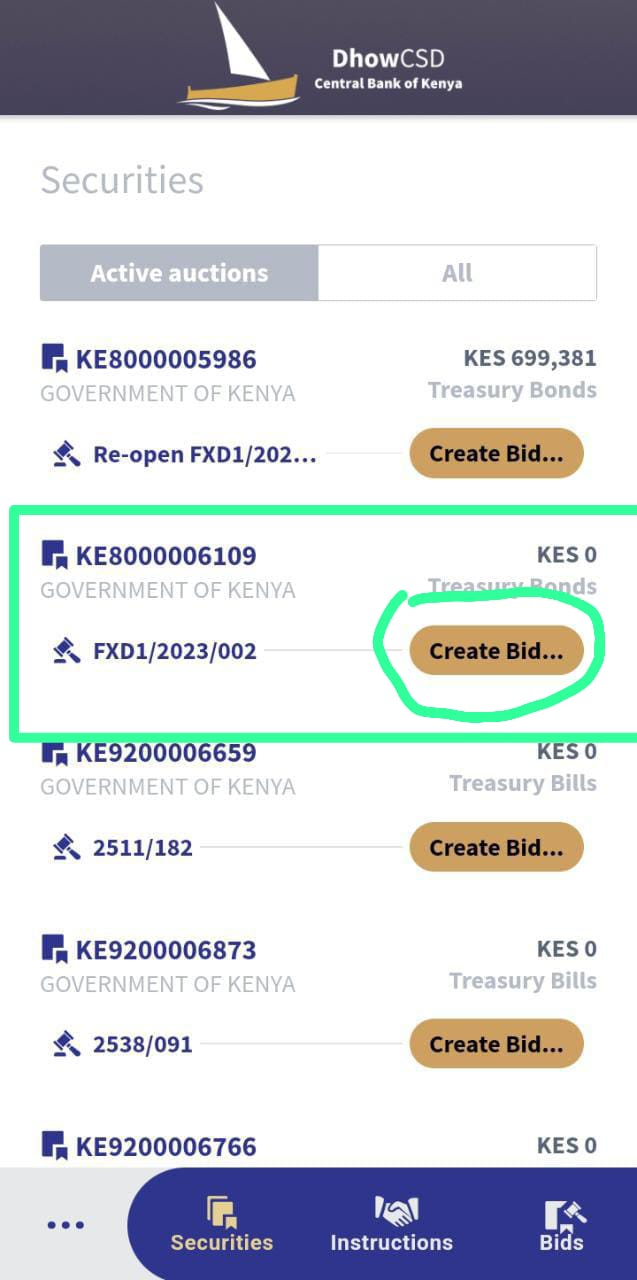

For this example, I will place a bid for the 2-year bond, FXD1/2023/2. First, I’ll find it on the list of bonds available for auction, then click on the “Create Bid” button next to it.

The placing bid page will display the bond details at the top. The first field you need to fill is to choose your bidding type:

I. Competitive Bid: This option allows you to specify the yield you want for the bond. However, competitive bidding is not recommended for retail or individual investors due to the lack of bidding guidance. Without this guidance, you risk paying a premium (more than the market rate) or a discount (less than the market rate) based on your chosen yield. Achieving a favourable rate is challenging without market insights.

Ii. Non-Competitive Bid: With this option, you accept the market-determined rate and will pay the par value if your bid is accepted. I generally advise retail investors to use this method, as it simplifies the process and helps avoid the risk of overpaying. Keep in mind that non-competitive bids are capped at KES 20 million for individual/retail investors.

5. Enter the Face Value

This is the amount you wish to invest in the bond. The face value of the bond is also the amount you will receive when the bond matures. The minimum investment is KES50,000, with any additional amounts required to be in increments of KES 50,000.

6. Choose the placing agent as “None”.

7. Enter your source of funds.

“Local” means payment will be made by a local commercial bank while “Offshore” implies payment will be made from a foreign account.

8. Enter the specific source of funds

9. Accept the fund & legal terms

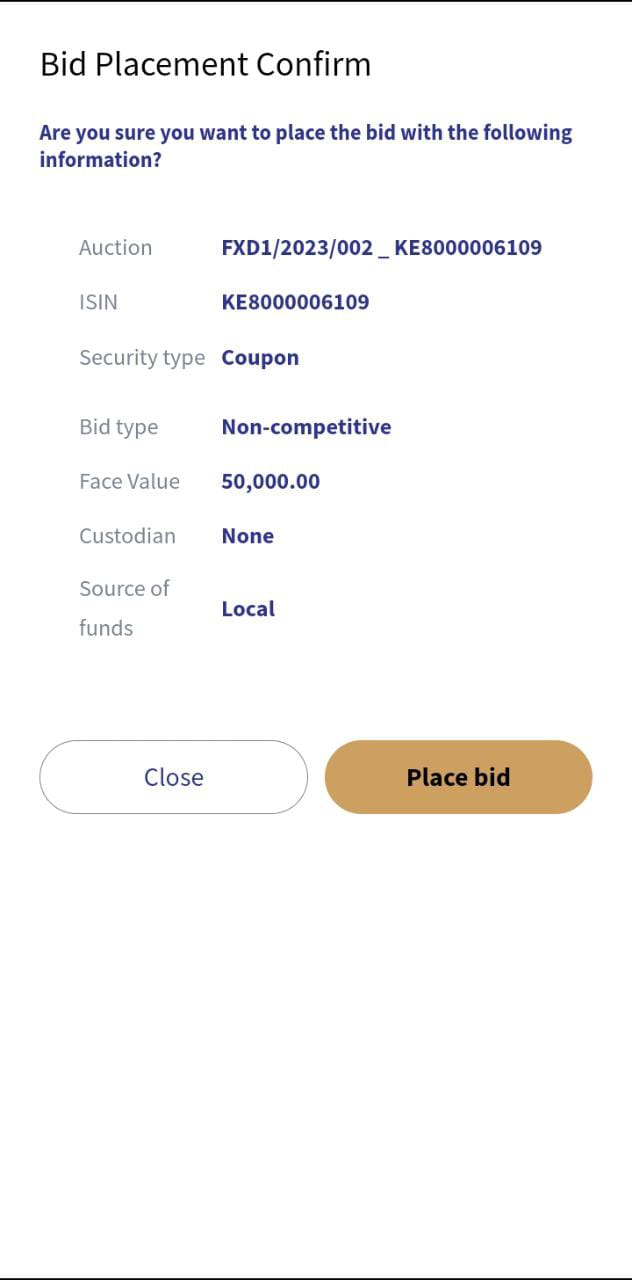

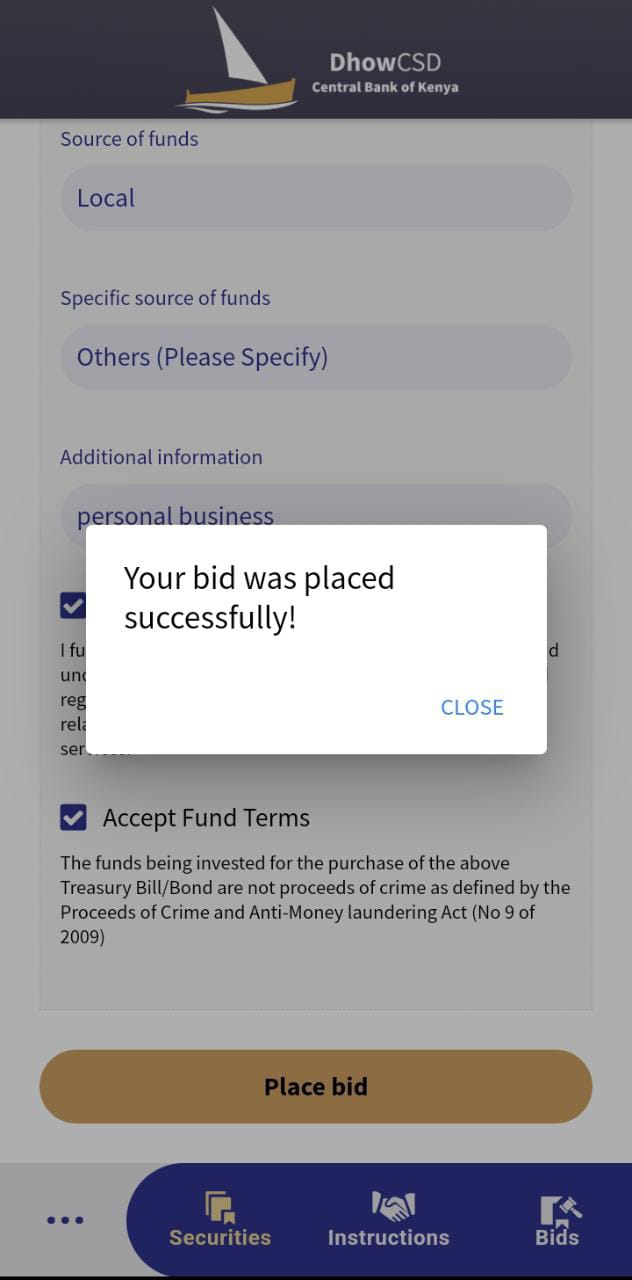

Then click on “Place bid”. You will then get a bid confirmation page having a summary of your bid. Click “Place bid” after confirming the details.

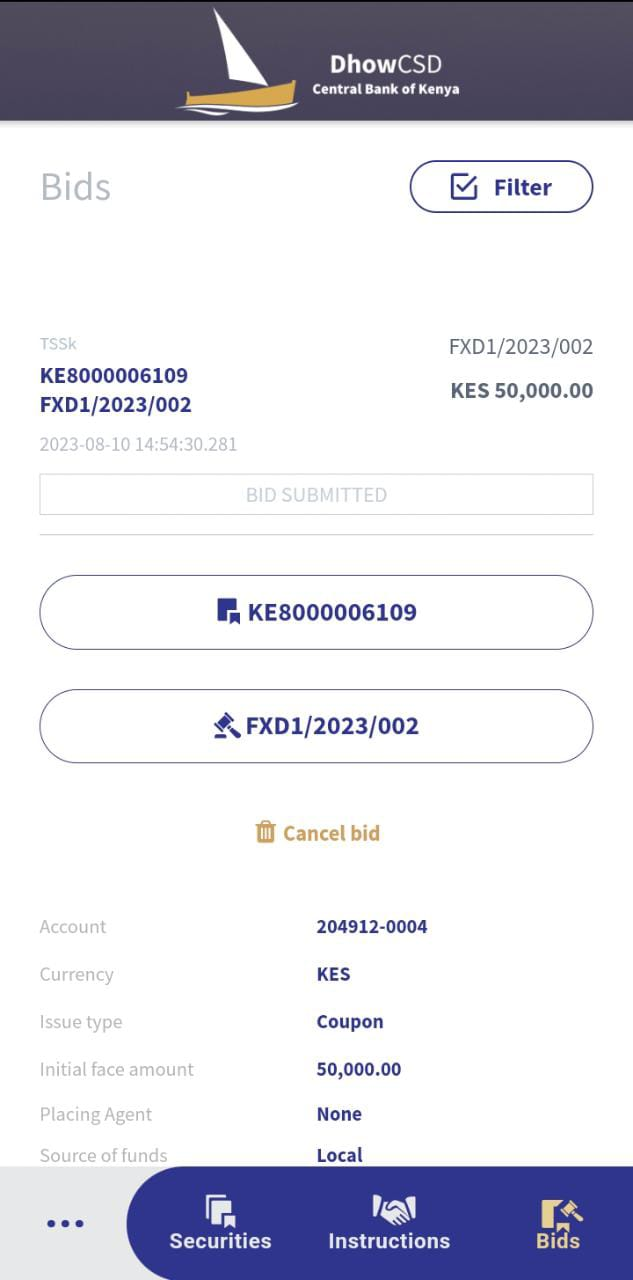

Once your bid placement is successful, you will receive a confirmation message. You can then view the details of your placed bids, and you also have the option to edit or cancel them under the “Bids” section.

After successfully placing your bid, you’ll need to wait for the auction results. For this example, the bond was available for sale in the primary market until 16/08/2023, and the auction results were announced the following day, Thursday 17/08/2023.

CBK will notify you via email or SMS whether your bid was accepted or rejected, along with the payment amount required. If your bid is accepted, instruct your bank to make the payment, typically through RTGS, as cash, mobile banking, and bank cheques are not currently accepted.

Contact your bank and provide your CDS account number and details to complete the payment. Make the payment promptly, as late or missed payments could lead to your account being blacklisted by CBK, preventing you from investing in bonds in the future.

That’s it on how to place a bid on the DhowCDS platform. If you found this article helpful, leave a comment about your experience with the platform and any potential improvements it needs. Also, check out my other articles on investing in the Kenyan market as well as free online financial calculators to aid in your investment journey.