Investing in Treasury bonds? If so, you’ve likely come across various strategies. In my previous article, I covered the basics of bonds and how they fit into your investment plan. Now, it’s time to dive deeper. The Bond Ladder Strategy can sharpen your bond portfolio, spreading risk and maximizing returns. Let’s see how it works.

A Bond Ladder is a carefully structured bond portfolio where each bond matures at a different time. This strategy ensures a steady stream of income while protecting you from interest rate swings. Instead of investing in bonds that all mature at once, you spread out the maturity dates over time.

How do you create a Bond Ladder?

To create a Bond Ladder, start by considering these factors:

- Rungs

Determine the number of rungs, or levels, in your ladder. Divide your total investment amount evenly across these rungs. For instance, if you have KES 1 million to invest, you could split it into 10 rungs of KES 100,000 each. This spreads your investment across multiple bonds with different maturity dates, balancing risk and return.

It is advisable to have at least six rungs on your ladder. It gives you the ability to structure ymyBond Ladder to generate monthly income throughout the year. Since bonds typically pay interest twice a year, staggering the maturities across different months ensures a steady flow of income every month.

- Spacing

Spacing refers to the time gap between the maturity dates of your bonds. The distance between rungs can vary, ranging from months to years. However, it’s important to keep the spacing as consistent as possible. This ensures a balanced and predictable flow of income as each bond matures.

- Height of the Ladder

The height of your ladder represents the overall length of time the bonds will mature. A taller ladder generally means higher average returns, as bond yields tend to increase with longer maturity dates. In simple terms, the longer you hold a bond, the higher the yield you can expect.

A Practical Example

Here’s an example of a Bond Ladder:

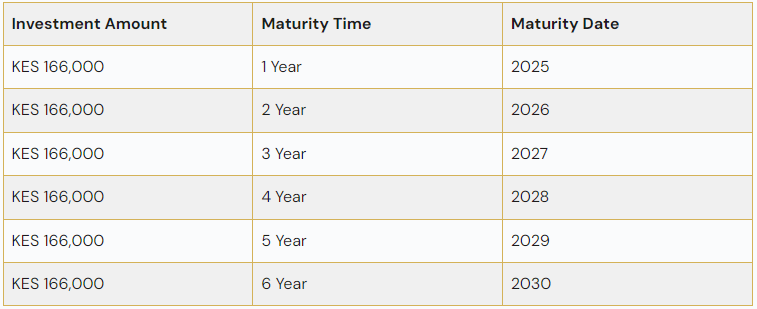

Suppose you have KES 1 million to invest in bonds. Instead of placing the entire amount in a single bond, you distribute it across a series of 6 bonds like this:

With this setup, you’ll have a bond maturing each year, providing interest payments and returning your initial investment. You can reinvest the proceeds into a new bond, continuing to build your ladder. For instance, when the bond maturing in 2025 returns your investment, you can use those funds to purchase a new bond with a 6-year maturity date, extending your ladder to 2031.

If you buy bonds at different times and spread them across 6 maturities, you can ensure monthly interest payments. Since each bond pays interest twice a year, spreading the purchase dates across months means you’ll receive interest from different bonds each month.

With an average return rate of 12% and a 15% tax on returns, each bond will pay you Sh 17,000 per year. Across the entire bond series, you’ll earn KES 102,000 annually. By spreading the bonds across different months, you’ll receive approximately KES 8,500 in interest each month.

Why Use a Bond Ladder? Here’s Why It’s a Great Strategy

A bond ladder offers several key benefits that make it a smart investment strategy for managing your income and maximizing returns. They include:

- Manage Cash Flow

Bonds typically pay interest twice a year, often on their maturity dates. By carefully timing your bond investments, you can create a predictable monthly income stream. This setup allows you to receive steady cash flow by spreading out bond maturities across various months and years.

- Adds Liquidity to YmyBond Portfolio

Bonds are usually less liquid, meaning you can’t access your cash without penalties until they mature. However, by investing in a series of bonds with staggered maturity dates, you ensure that a portion of your investment becomes available at regular intervals. This strategy helps maintain liquidity and provides access to cash when needed.

- Manage Interest Rate Risk

Staggering your bond maturities helps you avoid being locked into one fixed interest rate. This approach lets you benefit from varying rates over time, reducing exposure to interest rate fluctuations. It’s a preferred strategy for risk-averse investors who prioritize steady income over potential growth.

- Manage Inflation Risk

In periods of high inflation, bond returns often increase as investors demand higher interest rates. By having bonds mature annually, you can take advantage of rising rates and invest in new bonds with better returns, helping to offset the impact of inflation on your portfolio.

Potential Drawbacks of Bond Laddering

One downside of a bond ladder is that it requires a larger initial capital investment. Since you’re purchasing a series of bonds with different maturities, you need more funds to build a ladder that provides the desired income and liquidity.

Another potential drawback is the variability in interest rates. If you buy bonds when rates are low, you might lock in lower returns. This can affect your overall average return, especially if interest rates rise in the future and new bonds offer better yields.

A bond ladder offers a strategic approach to securing consistent income and enhancing liquidity, all while managing risks associated with interest rates and inflation. By diversifying bond maturities, you can create a more predictable income stream and potentially benefit from better returns as market conditions change. For more insights on investment strategies and financial planning, check out my other articles, including my detailed guides on different types of bonds and portfolio management. Explore my range of financial calculators designed to help you get a more in-depth understanding of your investments. Stay informed and make smart decisions with my expert resources.