Regarding Money Market Funds in Kenya, numerous options are available. Selecting the right fund for investment depends on your individual financial goals and requirements. In this article, we will outline key criteria to help you choose a Money Market Fund that aligns with your wealth management strategy.

In our previous article, we discussed Money Market Funds (MMFs) and their potential to enhance your wealth portfolio. MMFs are low-risk mutual funds that invest in highly liquid, short-term instruments. If you haven’t read it yet, I recommend doing so to gain a better understanding of what MMFs are and how they function.

Money Market Funds are evaluated based on two major criteria: assets under management and returns at a particular market day.

Evaluating MMFs by Assets under Management

Assets under management (AUM) refers to the total market value of the assets that an investment management company or financial institution manages on behalf of its clients. AUM includes the assets of individual investors, institutions, or funds that the firm manages, and it serves as a key indicator of the size and success of the firm.

A higher AUM typically indicates a more established and trusted firm, as it suggests that the firm is managing a significant amount of client capital. AUM can fluctuate based on the performance of the underlying assets, client contributions, and withdrawals. It is often used as a metric to compare the scale of different investment firms or mutual funds.

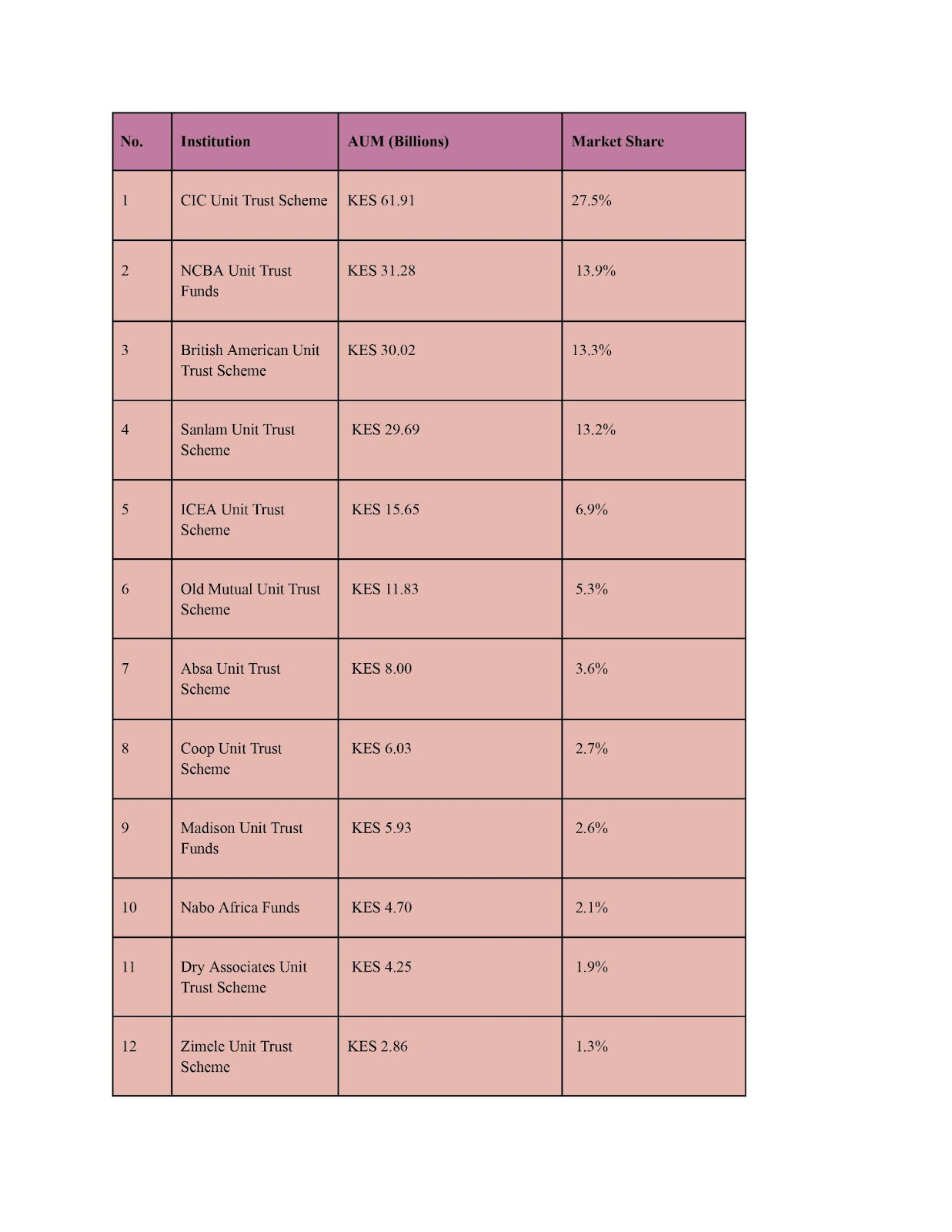

Let’s consider 12 of the most famous MMFs in Kenya and compare their AUM and corresponding market shares as of March 31, 2024

Evaluating MMFs by Returns on a Particular Day

Returns on a particular day for Money Market Funds (MMFs) refer to the income generated by the fund on that specific day, usually expressed as a percentage of the investment’s value. These returns typically come from the interest earned on the short-term, highly liquid assets that MMFs invest in, such as government securities, commercial paper, and certificates of deposit.

The daily yield (returns on a particular) is typically a tiny percentage, as it represents just one day’s worth of income. In most cases, the annual yield is used to compare different MMFs instead of the daily yield. This is because it provides a comprehensive and standardized measure of a fund’s performance over a full year. The annual yield is essentially the compounded result of the daily yields over the entire year.

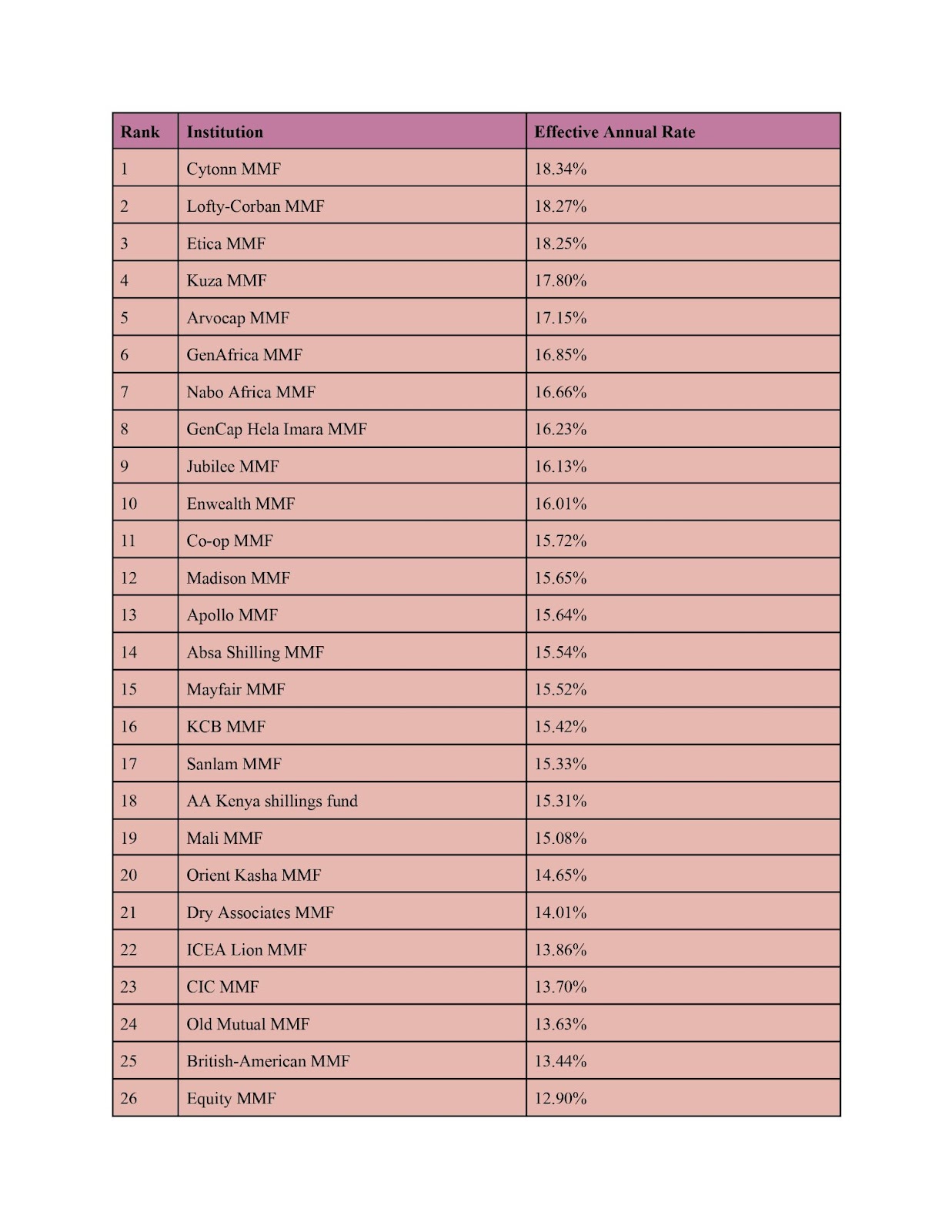

Here is a table of the top-performing funds in MMFs in terms of the effective annual yield as of 1st August 2024.

Other Considerations

In addition to evaluating returns and market share, it’s essential to consider other practical aspects that can significantly impact your overall experience with a Money Market Fund (MMF). Management fees, for instance, directly affect your net returns, making understanding the fee structure of any fund you consider crucial.

The minimum investment and top-up amounts are also vital, especially if you have specific budget constraints or plan to make regular contributions. Accessibility is another critical factor; whether it’s the ease of making deposits and withdrawals or the time it takes to access your funds, these elements can influence the convenience and flexibility of your investment.

Finally, the availability and format of monthly statements are important for keeping track of your investments and making informed decisions. All these considerations combined ensure that you select an MMF that not only offers competitive returns but also aligns with your financial goals and operational preferences.

With over 20 registered Money Market Funds (MMFs) in Kenya, obtaining information on all of them can be a daunting task. However, the funds listed here serve as a solid benchmark for understanding how MMFs in Kenya perform and operate. Hopefully, this guide will assist you in selecting a specific fund that meets your needs.

Should you be ready to start investing in an MMF, we recommend Kuza MMF or CIC MMFs. Both have proven performance records and offer affordable options with minimum investments of KES 5,000 and minimum top-up amounts of KES 1,000. You can quickly sign up for Kuza MMF here or CIC MMF here.

If you still have questions on money market funds, check out our Frequently Asked Questions on Money Market Funds article. You can also use our money market funds returns calculator to get a sense of possible returns under different conditions.